FINANCIAL PLANNING FIRM · PIXEL NIRVANA · 2017–2018

How can advisors run complex "what-if" portfolio scenarios without losing the client in numbers?

Overview

While at Pixel Nirvana Design Studio, I designed the advisor-facing UI for a goal-based financial planning web app. The product combines a risk questionnaire, portfolio modelling, simulations, and comparisons so advisors can guide clients from "what is your risk score?" to "here is the portfolio that fits you" in a single, coherent experience.

Challenges

- Workflows were scattered across PDFs, spreadsheets, and separate tools, making client sessions slow and fragmented.

- Risk scoring and portfolio analytics were powerful but hard to explain; clients saw numbers without context.

- Scenario tools (stress tests, historical simulations) felt technical and visually inconsistent.

Goals

- Give advisors a single workspace to move from risk profiling to portfolio creation, simulations, and comparison.

- Use clear visualisation so risk, probability, and allocation are easy to understand in front of clients.

- Simplify data entry for holdings and assumptions while enforcing rules (e.g., single allocation must not be 100%).

My role

UI & Graphic Designer – Pixel Nirvana Design Studio

- Designed the full interface for the Risk Score Lite questionnaire, portfolio-creation flow, and analytics dashboards.

- Defined a stable goal navigation (Summary, Goal Analysis, Loss Simulation, Historical Simulation, Add Securities, Risk Analysis, Portfolio Comparison).

- Created charts for projected balances, risk scores, probabilities, historical returns, and portfolio comparisons.

- Worked with domain experts to translate risk logic into clear UI states, validation, and error messaging.

Process snapshot

- Mapped how advisors currently onboard clients, capture holdings, and discuss scenarios; reduced this to a linear narrative from "risk score" -- "model portfolio" -- "comparison."

- Prototyped layout with a fixed sidebar for steps, tabs for Recommended / Current / Model portfolios, and a large canvas for charts and sliders.

- Iterated on the risk questionnaire and portfolio-details screens: sliders for allocations, inline validation when single allocation is 100%, and clear "add another stock/asset" patterns.

- Refined visual hierarchy of the Risk Dashboard, highlighting client name, goal amount, time horizon, risk score, portfolio score, and each holding's contribution to risk.

Selected screens

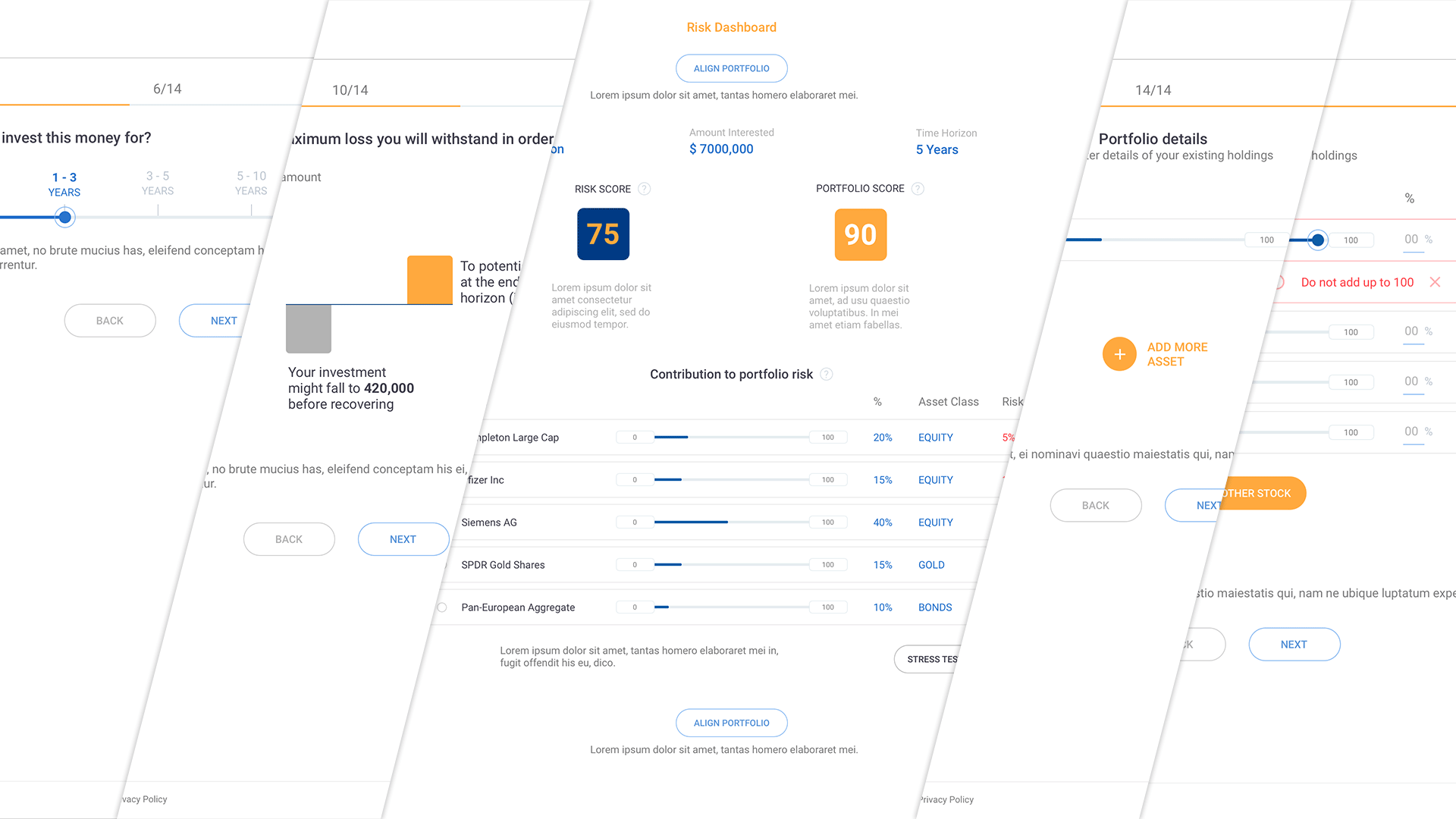

Risk Score process & dashboard

Multi-step flow that collects risk answers and existing holdings using sliders and inline validation, then surfaces a summary view of client risk score and portfolio score, with each holding's contribution to overall risk visualised through sliders and colour-coded percentages.

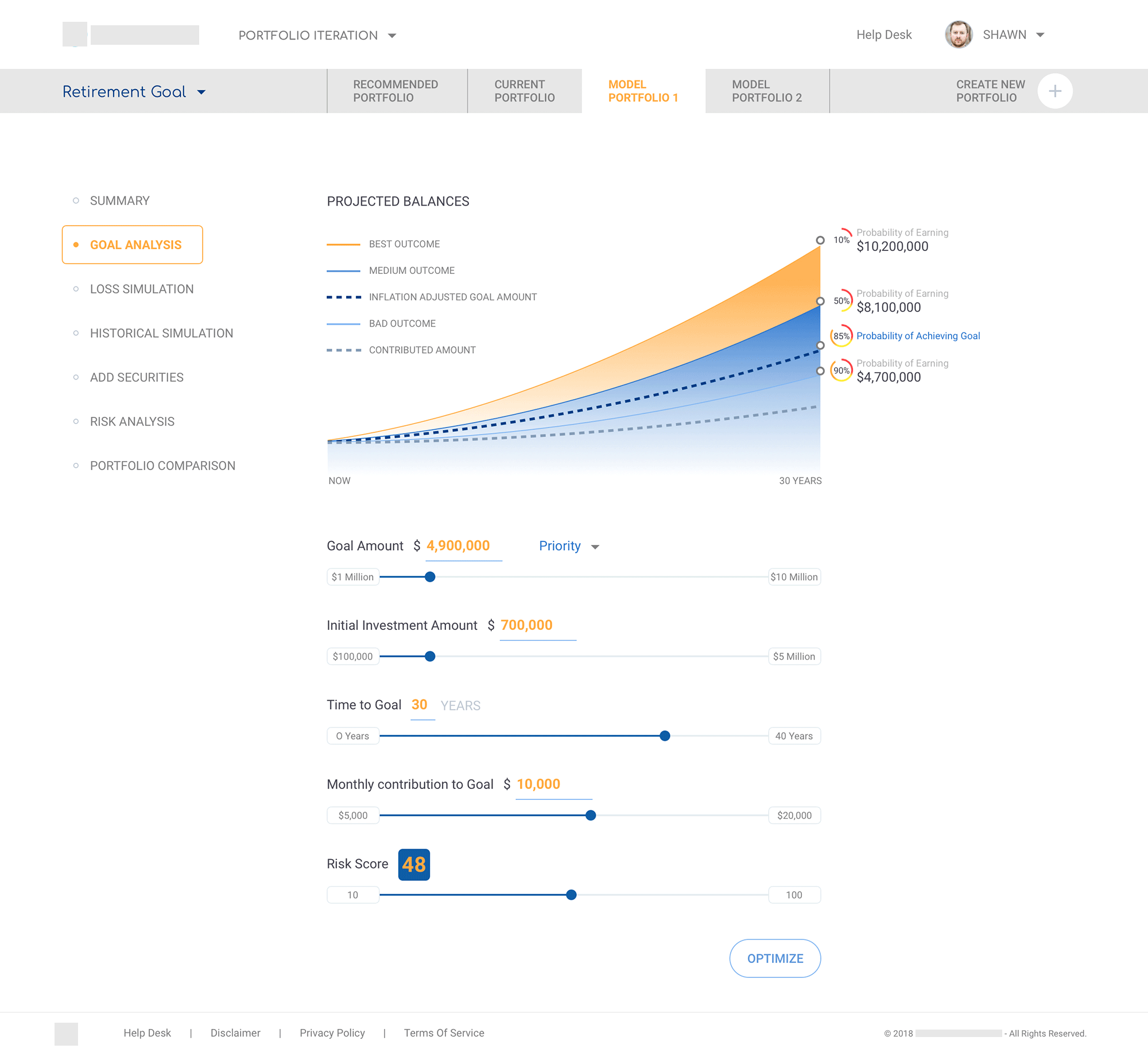

Goal Analysis

Projected balances graph with controls for goal amount, time to goal, contributions, and risk score, plus an "Optimise" action.

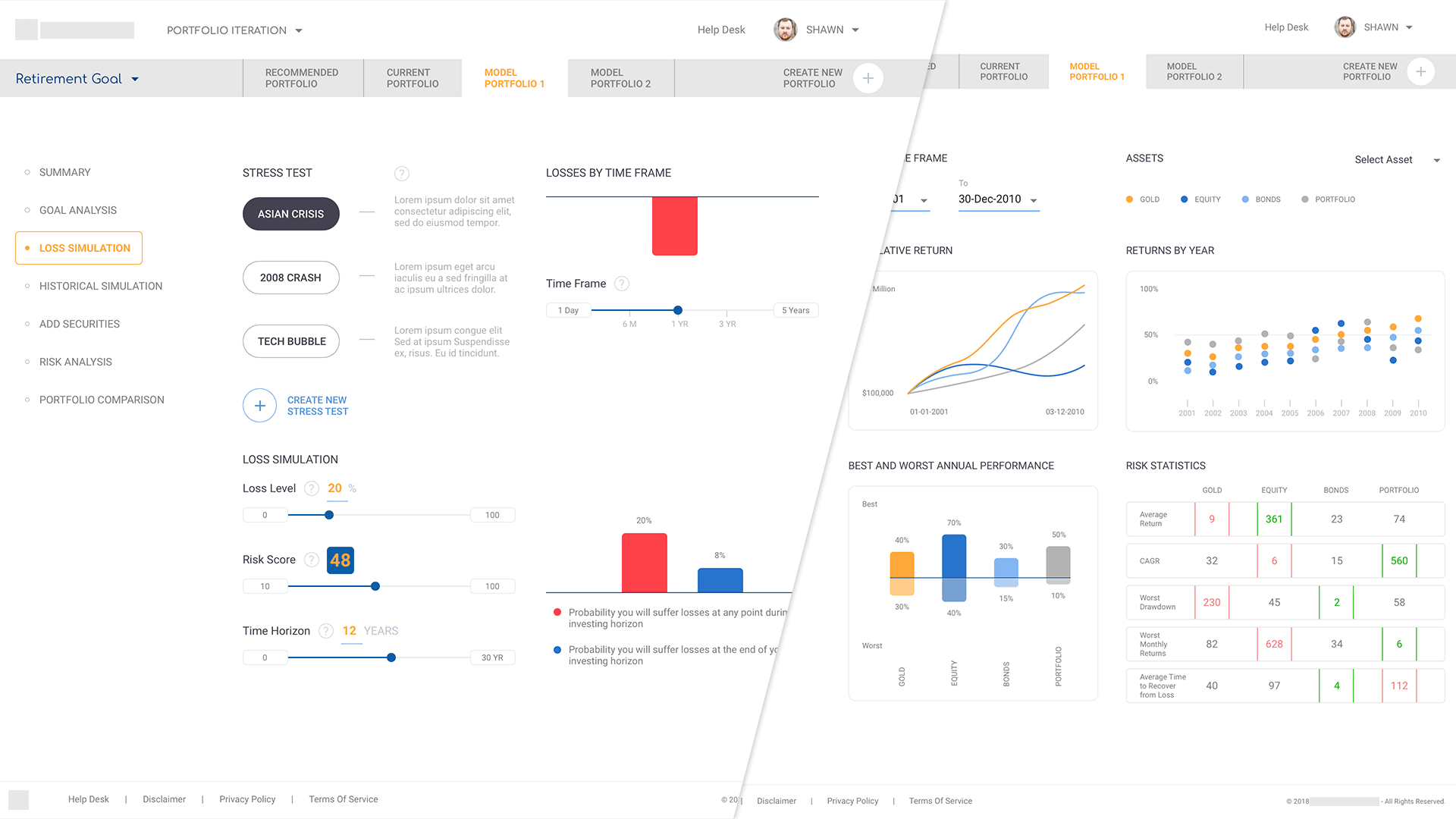

Loss & Historical Simulation

Visual tools showing stress scenarios and historical performance by asset class, with supporting statistics.

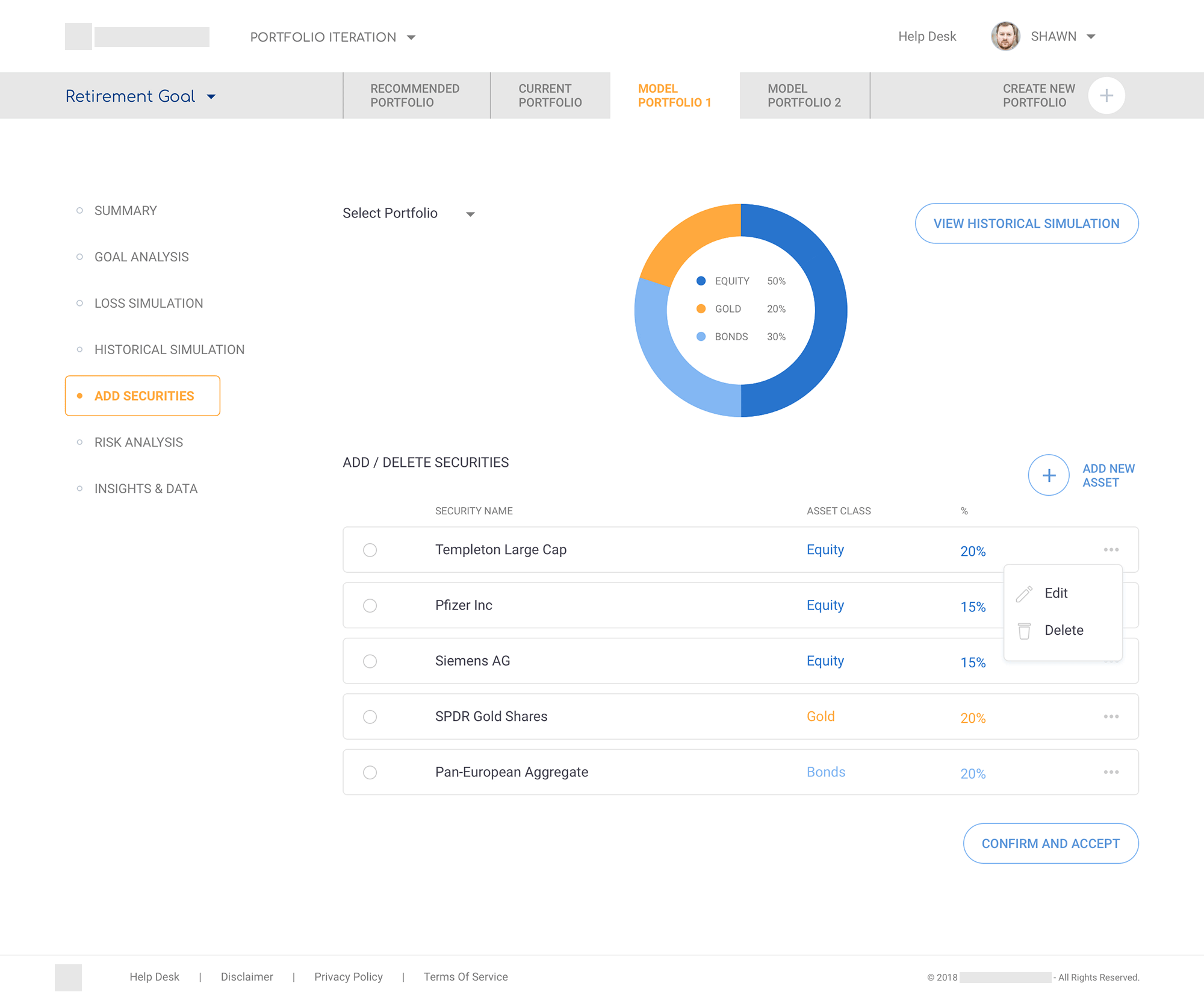

Add Securities

Donut chart summarising allocation above an editable table of securities; contextual menus for edit/delete.

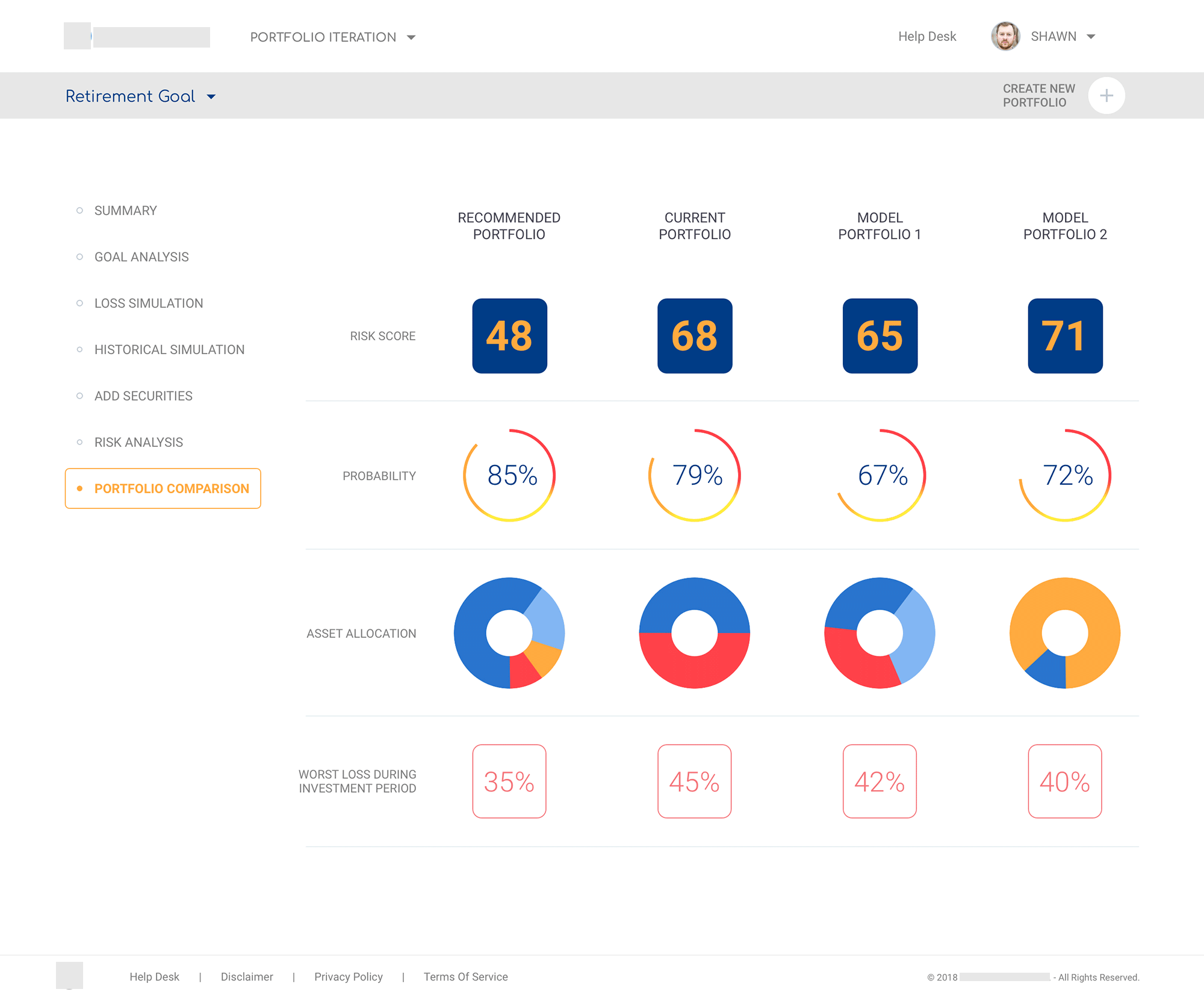

Portfolio Comparison

Side-by-side view of Recommended, Current, and Model portfolios using a row of risk and probability gauges, asset-allocation donuts, and worst-loss metrics.

Impact & reflection

The new UI turned a collection of disconnected tools into a single, session-ready workspace. Advisors can now move from risk profiling to modelling, simulations, and comparisons without breaking flow, while clients see risk and returns expressed through consistent visuals instead of raw tables. The project deepened my experience in financial UX and data visualisation, especially around designing tools that must serve both professionals and clients live in the same room.

More case studies

Sports analytics startup · Agency project

Sports Analytics Dashboard

Sponsorship index dashboard for a UK-based sports data startup. Combined TV, social, search, and live audience data into a single dashboard that helps brands compare sports assets and value sponsorships in real time.

Global automotive manufacturer · UST

Enterprise Data Catalogue Platform

Enterprise data catalogue with complex IA, approvals, and role-based access. Led UX and UI from first heuristic evaluation through a bespoke design system that now powers data discovery and governance across the organisation.

Pareza Group · Remote

Wallet & Chat Apps (White-label)

Mobile wallet and messaging apps plus supporting web tools, designed as a white label system for multiple clients and regions. Built reusable UI foundations that keep branding flexible while flows stay consistent.